Little is known and documented regarding the economic viability and sustainability of smallholder pig enterprises. To date, it remains a challenge to acquire reliable data from smaller farms that can be used to analyse their performance. The assumption is that there are no systems in place that will allow farmers to provide reliable data. Traditionally, profitability is linked to economies of scale. However, with little to no reliable data available, little is known about what drives the sustainability of smallholder farms. Due to these challenges, a record-keeping survey was conducted on 128 farms with the aim of investigating the extent to which smallholder farmers keep financial records for their enterprises.

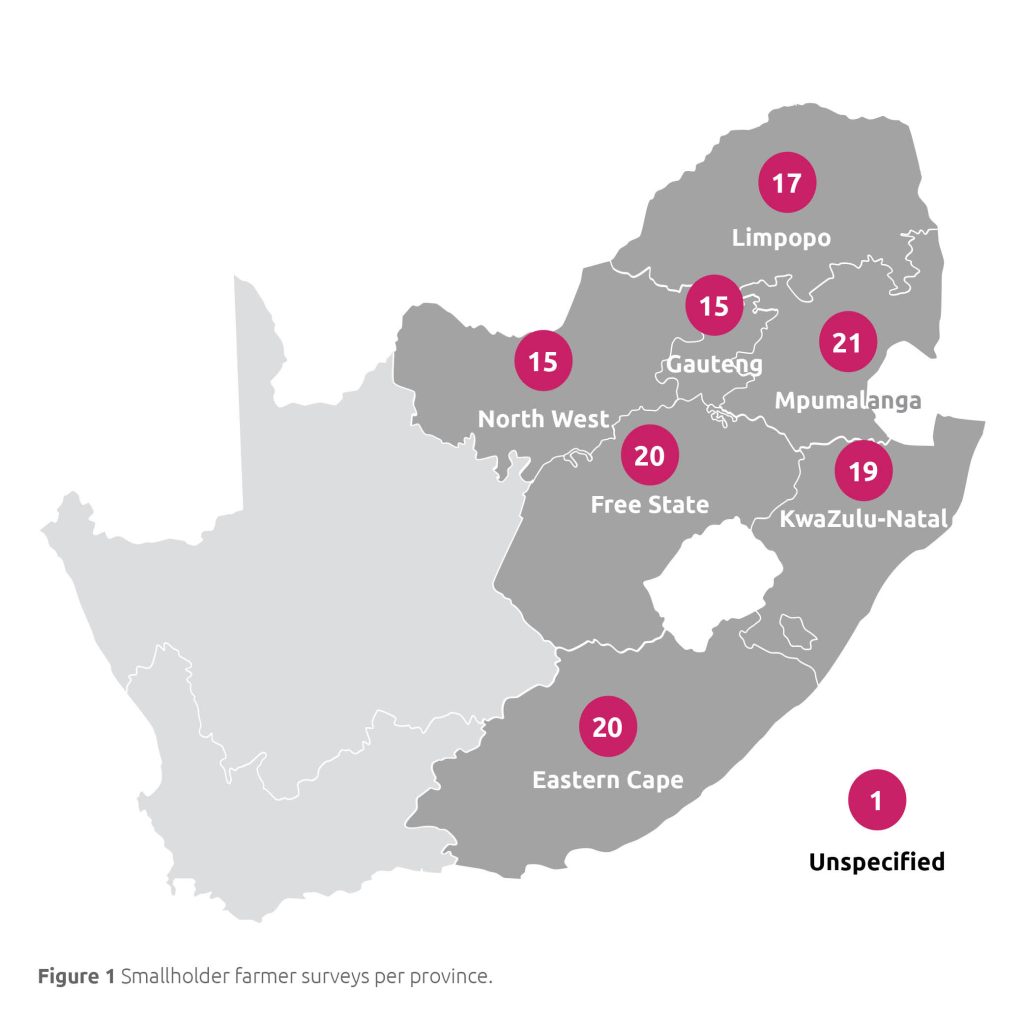

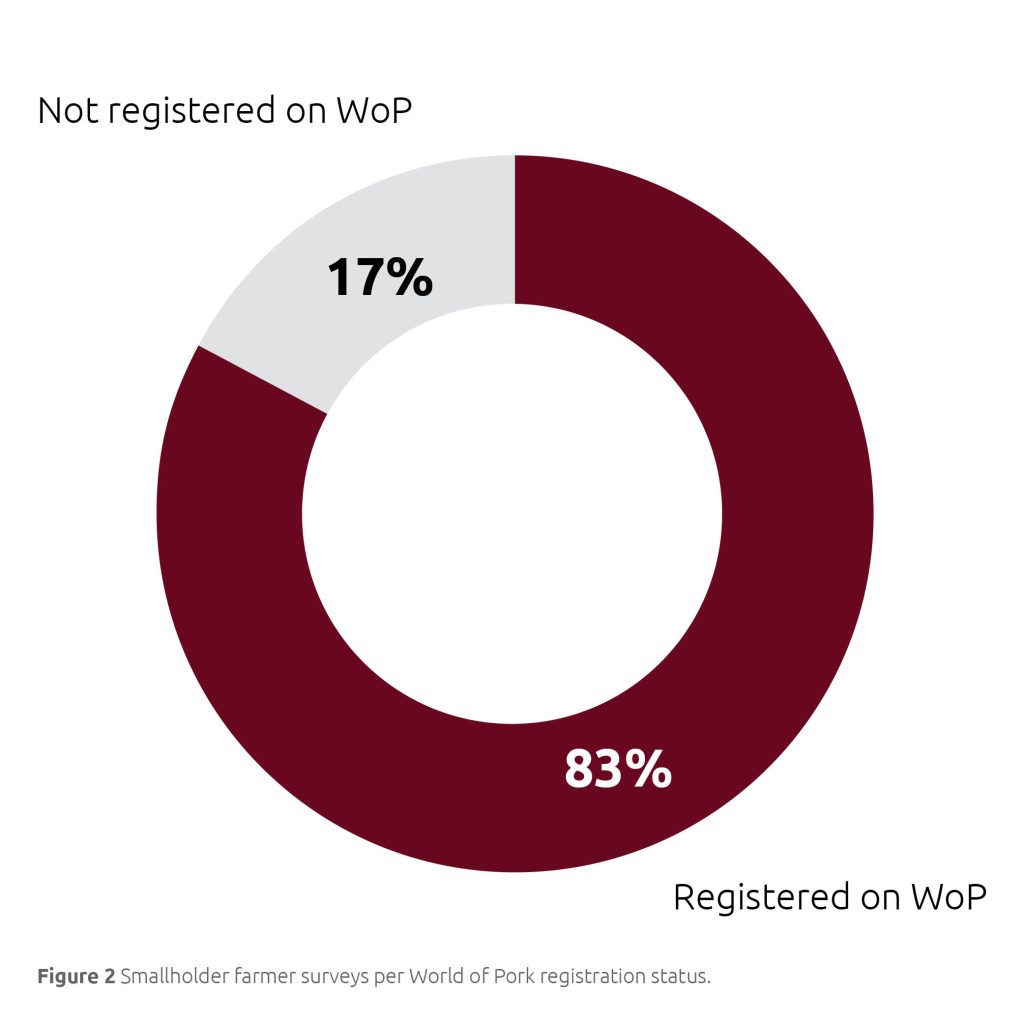

A total of 128 farmers representing seven provinces were interviewed (Figure 1). Of the interviewees, 83% are registered on the World of Pork (WoP) platform, and 17% are not registered but are receiving technical support from SAPPO’s business development programmes (Figure 2).

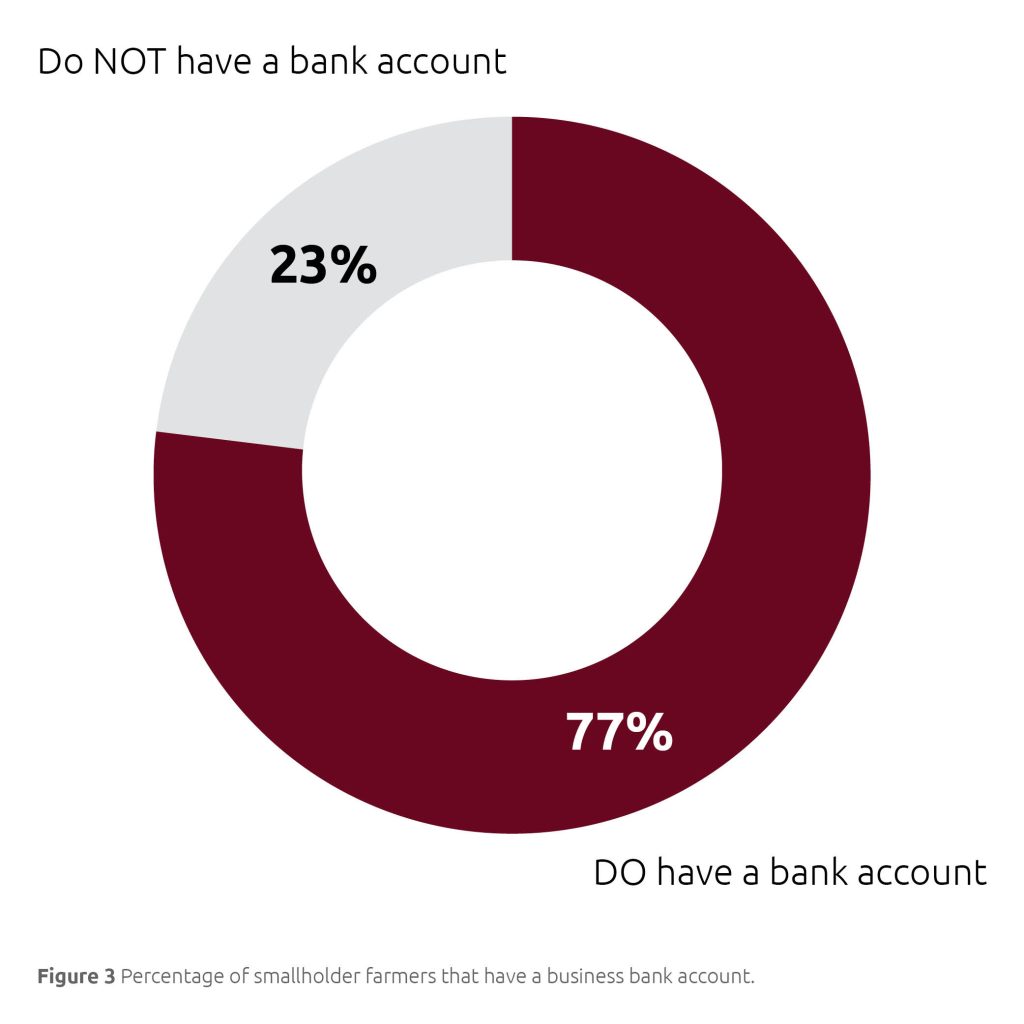

As per Figure 3, the results from the record-keeping survey indicate that 77% of the respondents confirmed that their enterprises have business bank accounts. However, these bank accounts are often used for multiple business enterprises, which appears to make separating specific transactions a cumbersome exercise. This has resulted in farmers not being able to track activities per industry.

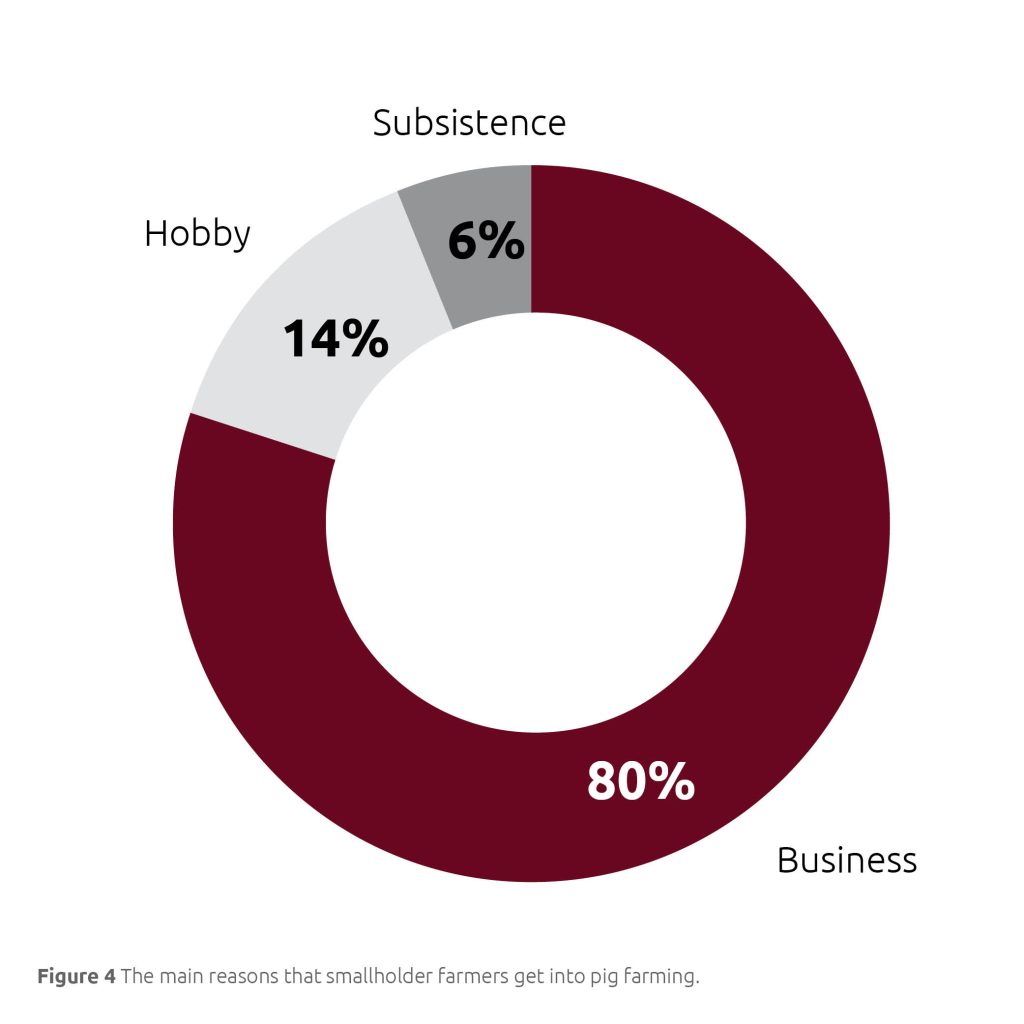

The exact number of smallholder and developing pig farmers is unknown, mainly because the majority of these farmers are not affiliated with any particular body. Additionally, many of these farmers do not sell their properties if and when, for various reasons, they stop production. When their economic situation improves, production will also recommence. This prompted some curiosity into the reasons why people get involved in pig farming (Figure 4).

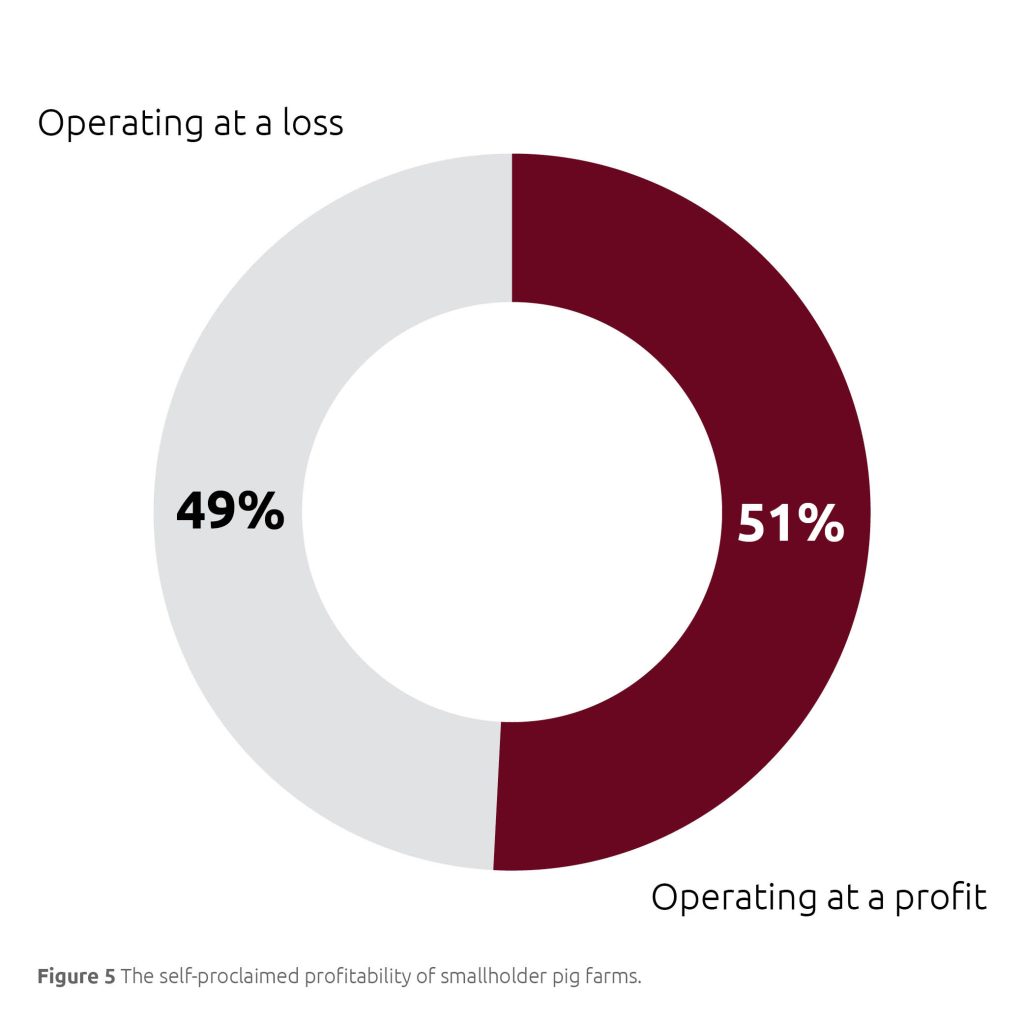

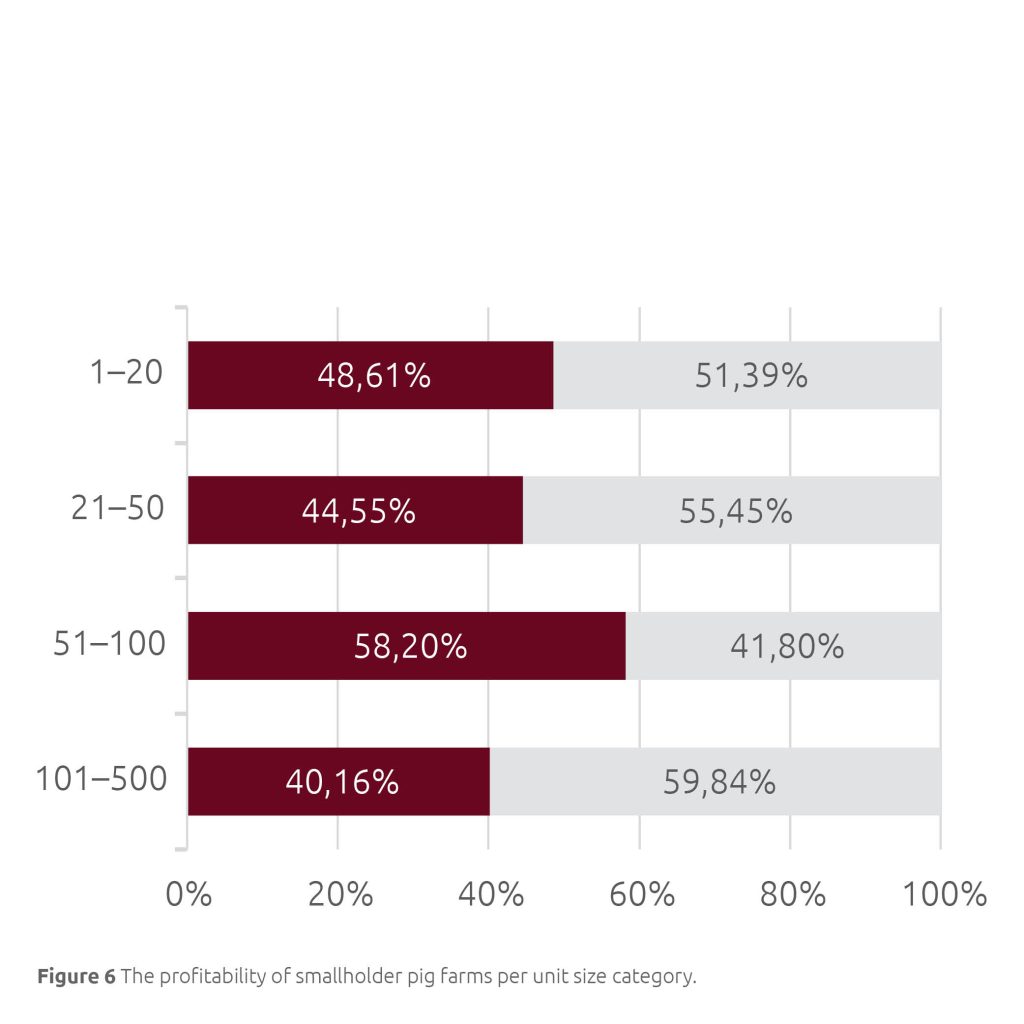

The belief is that pig businesses producing at a small scale are not profitable, mainly due to economies of scale. The results from this survey indicate that 51% of the farmers interviewed mentioned that their small businesses are operating at a profit rather than a loss (Figure 5). These are mainly units operating with between 20 and 50 sows, as compared to units operating with between 51 and 100 sows. Figures 5 and 6

show the relationship between profitability and unit size.

Conclusion

This survey proved that farmers do, indeed, have business bank accounts. However, due to multiple operations conducted under a single account, this appears to be a hindering factor for farmers to provide reliable records. Many farmers view multiple operations as one, where one operation’s income will be used as a rescue effort for an operation under financial constraints. It remains a challenge to determine the profitability of smallholder pig businesses as there are no reliable records or records relating only to their pig production enterprises. This, even though farmers verbally confirmed that their small businesses are profitable, supported by the fact that they often remain operative for several years.

This article was first published in the Winter 2023 issue of PORCUS PrimeCuts.