We enter 2020 with a host of unusual and unpredictable events. In other words, there is huge opportunity for those who can read the signs of the times. For example, the $717-million trade deal between JBS SA in Brazil and China’s WH Group (parent company of Smithfield Foods in the U.S.) should open tens of thousands of direct marketing opportunities in WH’s established points of sale in China. It will move pork as well as beef and chicken across China.

The Chinese will likely reduce their total per capita consumption of pork substantially for the long term, if not permanently. That will require a massive permanent reduction in backyard farms, movement restrictions on live pigs (already implemented) and a reshaping of demand around the dietary preferences of the younger Chinese consumer.

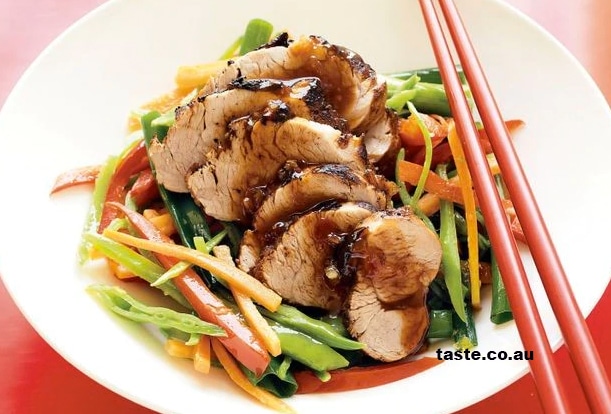

The focus is inevitably shifting toward safe, higher value cuts along with smaller portions and a shift toward poultry and seafood. It will also require fully integrated production and marketing chains to handle the variety of risks going forward.

Read more

The South African Pork Producers’ Organisation (SAPPO) coordinates industry interventions and collaboratively manages risks in the value chain to enable the sustainability and profitability of pork producers in South Africa.